Start Your Expedition

How does Digialization work?

Digitalization should be pursued deliberately and with clear objectives to create measurable added value for the company and meet the expectations of finance customers, rather than generating frustration and rejection as an end in itself. These expectations may include the classic improvement of efficiency through process automation, or even a qualitative enhancement of finance products through increased significance in data analysis. It is crucial to establish clarity on both the objectives and the path forward at the very beginning. We refer to this roadmap as the "Digital Agenda."

Initially, operational issues are typically addressed. However, it is also essential to broaden the perspective and look forward. Most companies are either on the verge of or already in the midst of major transformations that are coming our way. The triggers for a transformation vary but share the commonality that their impacts will be significant, necessitating immediate action. By assessing each trigger and handling them individually, companies can position and evaluate themselves within the adjacent matrix.

Triggers for Transformation and Potential Areas for Action

Many companies are facing significant transformations triggered by various factors:

Skills Shortage:

- There is a lack of employee capacity, which can be compensated for through the automation of transactional tasks.

- Capacity planning should be based on skills to enable long-term workforce planning.

Volatility:

- Analytical structures need to be adjusted more frequently to manage large volumes of data effectively.

Business Model Changes:

- New digital business models

- Altered corporate governance

- Ensuring the financial viability of new ventures

Regulation:

- Invoices should be issued and received digitally, and regulatory reports must also be submitted digitally to meet legal requirements.

Managing Complexity:

- In addition to the original task of determining financial metrics, finance now collects many other types of information, often with significantly increased complexity in data collection, such as the capture or estimation of annual CO2 emissions across the entire supply chain.

By focusing on the expectations of your finance customers and clearly identifying your triggers for transformation, you can ensure that your digitalization projects deliver real added value and are successful in the long term.

Digitalization in finance goes beyond technology; it transforms processes, securing the future viability of your business.

Our Approach

Strategic Alignment in Digital Finance: Precisely Managing Efficiency, Flexibility, and Quality

When aligning future actions, it is crucial to decide whether to primarily react to legal requirements or to ensure the future of the company and its business model with a set of measures. The stakeholders involved differ with each approach, as do the time horizon and the scope of the measures.

With the help of a predefined matrix, we categorize the array of challenges into different categories, allowing us to distinguish between operational and strategic areas for action, as well as between potentials for efficiency, increased flexibility, and quality improvement.

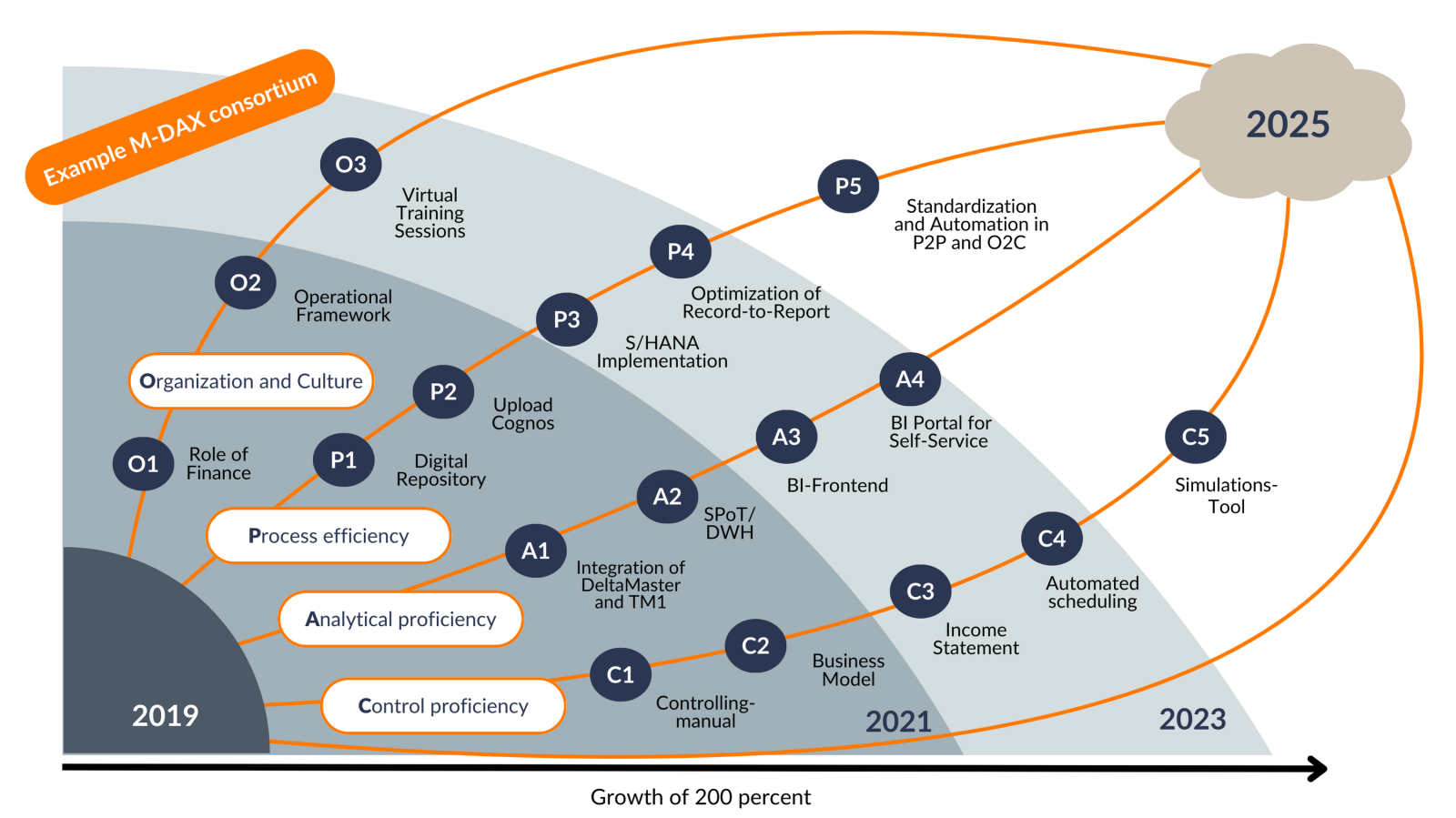

Prioritisation and roadmap for the Digital Finance Agenda: structured planning of measures for the future

This categorization enables the prioritization of measures and considers the content and structural dependencies between them. Based on this, a roadmap for the Digital Agenda is developed to approach the coming years in a structured manner with a clear goal in mind.

Rely on our expertise in Digital Finance to successfully realize your Digital Agenda-contact us now.

Your Benefits

Increased Efficiency

Digital Finance enables significant efficiency gains through the automation of repetitive and manual processes. This reduces the likelihood of errors and speeds up processing times, leading to improved productivity and cost savings.

Improved Decision-Making

The integration of digital tools allows for deeper and quicker data analysis, enabling more informed decisions. Finance teams can use real-time data to identify trends, make forecasts, and refine financial planning.

Increased Transparency and Control

Digital Finance offers better oversight and control over financial transactions and processes. Centralized dashboards and reporting tools enable companies to monitor and manage their financial operations, leading to improved compliance and risk management.

We support your Transformation.

Why 4C?

As an experienced management consultancy, we are your ideal partner for implementing Digital Finance. We offer in-depth expertise, a proven methodology, and practical solutions. Our expertise enables you to successfully digitize your finance department and achieve sustainable competitive advantages. Feel free to contact Peter Keefer directly to start your Digital Finance transformation and prepare your finance department for the future.

4C Insights

4C Whitepaper: "Digital Finance"

Download our Whitepaper to learn how digitalization is driving the transformation of financial processes and roles, making strategic realignment and data-driven decision-making essential.

4C Whitepaper: Reporting Factory - Reporting and Digitization

Reporting 4.0 enables digital and efficient reporting. The challenges of implementation are addressed while implementing best practices of a "Reporting Factory."

4C Whitepaper: Automation of purchase-to-pay processes

Find out how digitalization is revolutionizing procurement. Read now!

4C E-Booklet: Robotic Process Automation

Understanding Robotic Process Automation is achieved by exploring its applications and functions, as well as developing a roadmap and providing a market overview of RPA solutions.

More Topics

Your Temporary Co-drivers

Contact Us

We would like to point out that this website provides only a limited insight into our services. Our expertise and the full range of our capabilities cannot be completely represented on this platform. For personalized consultation and to address your specific concerns in the most effective way, we warmly invite you to contact us directly so we can offer you tailored solutions.

Thank you for your trust. We look forward to hearing from you.