Start Your Expedition

Combating money laundering, terrorist financing, fraud and sanctions violations

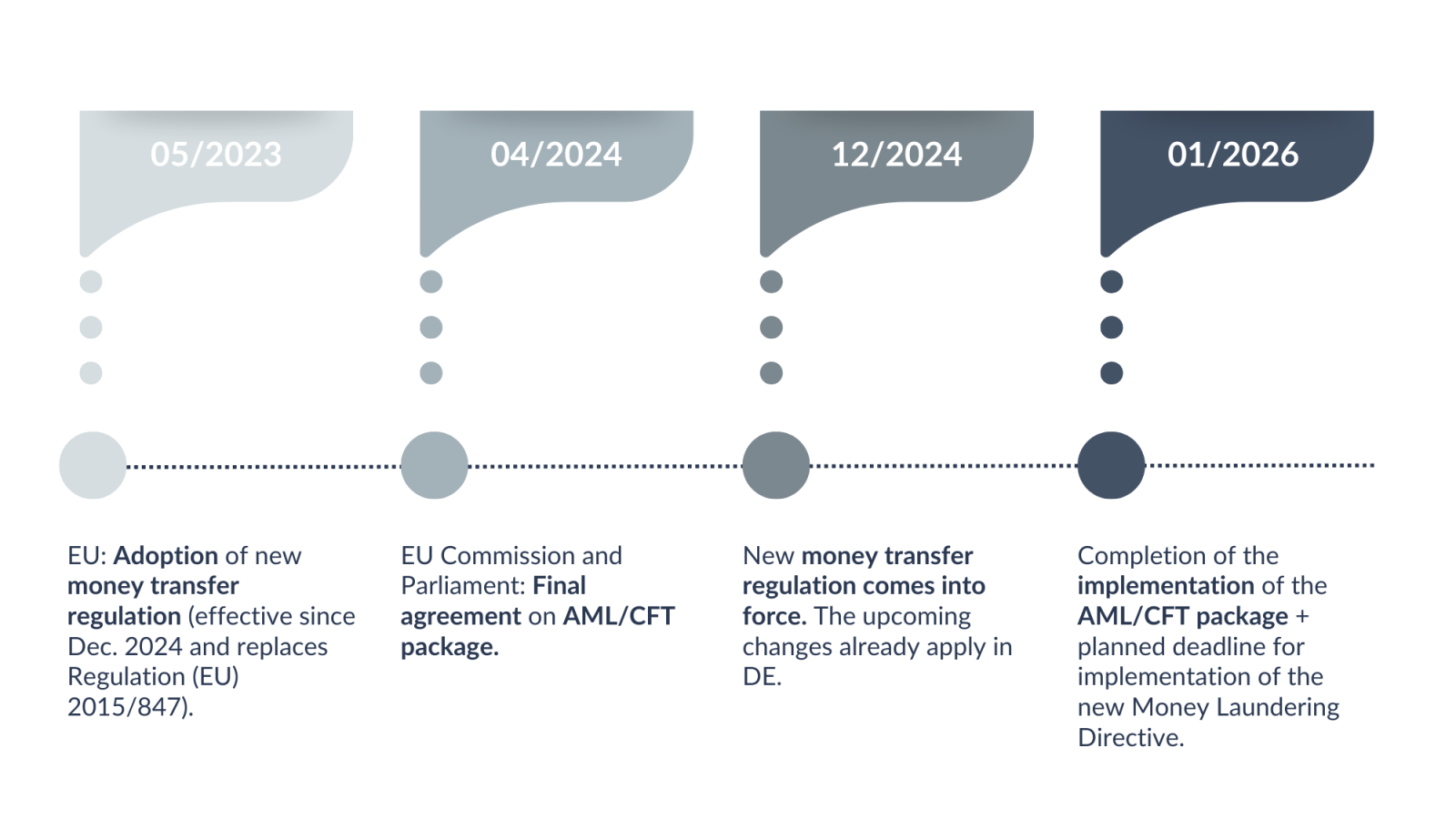

Preventing money laundering and combating the financing of terrorism (AML/CFT) are at the heart of current regulatory developments in the EU. With the EU AML/CFT package introduced in 2021, the European Union has created a comprehensive framework to further strengthen and harmonize the fight against financial crime. This package includes important innovations, including the revision of the Money Transfers Regulation, a new Money Laundering Regulation and Directive and the establishment of the central supervisory authority AMLA.

A central component of this package is the 6th EU Money Laundering Directive. It tightens the transparency requirements for beneficial owners and improves cooperation between national Financial Intelligence Units (FIUs) and supervisory authorities. Companies need to rethink and adapt their governance structures to meet the new requirements. This includes establishing a solid governance model for communication with AMLA and national supervisory authorities and developing a data management and exchange framework to efficiently handle information requests.

In addition, the directive requires the development and implementation of internal policies and procedures to enforce targeted financial sanctions and comply with the new EU-wide due diligence requirements (KYC). Group-wide implementation of the Regulatory Technical Standards will also be crucial to standardize compliance processes and ensure adherence to the new regulations.

Key components of the EU AML package:

- Funds Transfer Regulation

- Money Laundering Regulation

- Money Laundering Directive

- AML Authority

The member states have until July 10, 2027 to transpose these extensive requirements into national law. It is crucial to act early in order to minimize legal risks and meet the new regulatory standards. At the same time, this offers the opportunity to increase operational efficiency and build a robust compliance structure that can cope with future requirements.

4C Events

The Anti Money Laundering Authority (AMLA) is the new central EU supervisory body responsible for combating money laundering and terrorist financing. It assumes extensive powers and direct oversight of 40 selected institutions considered to be of high risk. Its responsibilities include close collaboration with national supervisory authorities, monitoring financial transactions, and maintaining a central database for risk assessment. AMLA is expected to be fully operational by 2026 and will ensure strict compliance with European regulations on financial crime prevention through inspections, evaluations, and sanctions.

Companies need to establish a governance model for collaboration with AMLA, adjust their data management and governance structures, and develop internal strategies to ensure compliance with the new EU regulations and sanctions. Additionally, they are required to implement the EU Know Your Customer requirements and the Regulatory Technical Standards across their groups.

Obligations in Anti-Money Laundering Prevention

The obligations for anti-money laundering and counter-terrorism financing stem from various laws such as the Money Laundering Act (GwG), requiring transparency and security measures. A risk-based approach is central, obliging entities to have effective risk management and conduct risk analyses. This includes documenting, regularly reviewing, and updating risk analyses, as well as providing them to supervisory authorities. Internal security measures aim to control and mitigate risks, including developing principles, procedures, controls, and training employees.

Key Levers in Anti-Money Laundering Prevention

Our experience has shown that there are five key aspects in anti-money laundering prevention: employee reliability and expertise, supported by regular training, are crucial. Product design requires thorough assessment for money laundering susceptibility, especially for new products. Customer screenings and adjustments to the KYC process, along with regular reviews, can significantly reduce money laundering-related risks. Monitoring, filtering, and validating transactions, as well as investigating suspicious cases, require special attention, with new technologies enabling efficiency gains without increasing workload.

Success Factors

Efficient Regulatory Management

Conversely, it remains a common challenge for financial service providers to manage high manual processing efforts associated with numerous, inflexible legacy systems, redundant structures, and complex, dynamic regulations. By leveraging Lean Management and the adoption of new innovative technologies, these issues can be addressed, opening up new opportunities for effective and efficient Regulatory Management. Classical Lean Management aims to create value without waste, prioritizing customer orientation, highly efficient processes, and the pursuit of perfection. The use of cutting-edge technologies to support Regulatory Management functions (RegTech) leads to a relief of regulatory processes, increased efficiency, and heightened effectiveness. For more in-depth information, feel free to explore our E-Booklet on this topic.

4C E-Booklet: Compliance Efficiency

Introduction and overview of "Compliance Efficiency" and Regulatory Technology.

Our Approach

How we support you

With our expertise and years of experience, we offer you targeted services for anti-money laundering projects. From customer onboarding and the KYC process to transaction monitoring and suspicious activity management, we enable you to successfully address your change needs. This also includes setting up and managing comprehensive initiatives such as awareness training for employees and executives. What do we never lose sight of? The focus on maximum effectiveness and efficiency of processes and structures.

- Determination of the relevant regulatory framework

- Recording of the current AML (Anti-Money Laundering) organization/strategy

- Identification and documentation of process clusters, process map

- Recording of existing reporting, control, and data management structures

- Business model-specific impact analysis

- Processing of existing information and analyses

- Analysis of procedural and process descriptions

- Systematic breakdown, modification, and documentation of all relevant process steps

- Prioritization and (project) planning of required action needs

- Conceptualization of the corresponding approach

- Operationalization across all transformation dimensions

More Topics

Your Experts

Jobs @ 4C

Feel free to contact us.

We would like to point out that this website only provides a limited insight into our services. Our expertise and range of services cannot be fully represented on this platform. For personalized advice and to address your specific concerns most effectively, we warmly invite you to contact us directly so that we can offer you tailor-made solutions.

Thank you for your trust. We look forward to hearing from you.