Start Your Expedition

Setting preventive measures and standards

Combating fraud and corruption is an essential part of compliance management. Violations and offenses not only have a very negative impact on the reputation of the organizations involved but can also lead to significant fines upon discovery.

The main tasks that prevention should encompass include:

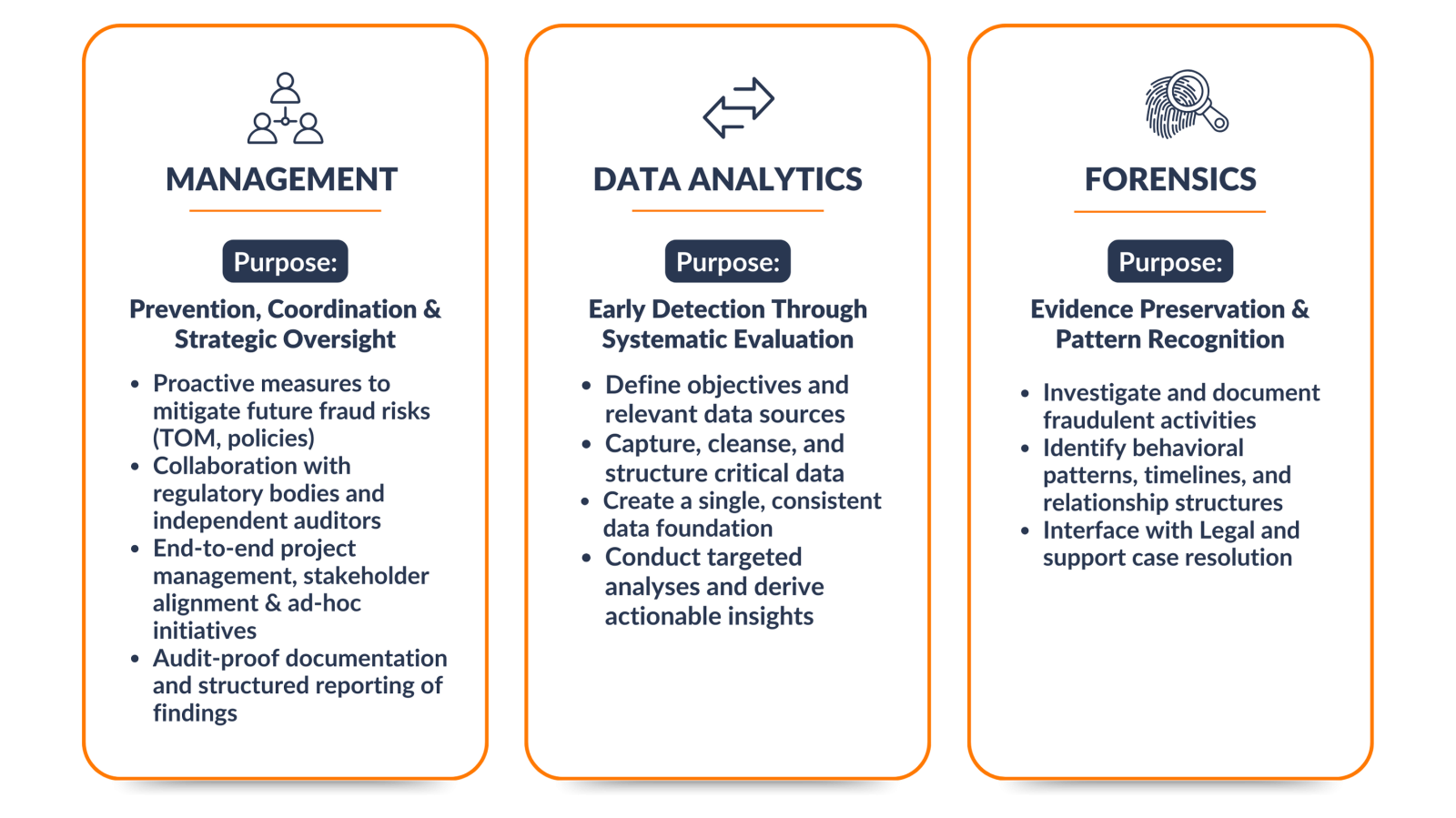

Based on our experience, there are three core pillars that form the foundation of effective fraud and corruption prevention.

-

Strategic Management: Effective prevention starts with structure. Only through clear responsibilities, transparent processes, and thoughtful project and stakeholder management can preventive measures be sustainably embedded within the organization.

-

Preventive Forensics: Preventing future cases of fraud and corruption requires a deep understanding of past criminal behavior. This is achieved through systematic investigation and analysis of historical incidents.

-

Data Analytics: Collecting all relevant data is one of the most critical steps in preparing for comprehensive analysis. Leveraging data analytics helps uncover anomalies, process patterns, and irregularities that may indicate fraudulent activity.

Successfully addressing these tasks requires more than just good intentions. An essential step towards efficient and sustainable management is the establishment of an Investigations Office as it ensures a structured approach to conducting investigations and implementing preventive measures.

Relevance

Prevention in fraud and corruption control is crucial for several reasons

Ideally, offenses and misconduct that never occur are the primary goal of fraud and prevention efforts. Therefore, institutions and companies are increasingly investing in prevention rather than reactive measures. The aim is to avoid misconduct rather than conducting post-event root cause analysis and damage control. IT-supported processes and controls, detailed process guidelines, and policies form the essential basis for such measures. Targeted training and employee awareness have a significant impact on detecting and preventing fraud and corruption cases.At the same time, the innovation of fraudsters necessitates both holistic and case-specific measures and precautions in prevention efforts.

Your Benefits

With our experience in fraud and corruption control and our expertise in new technologies and methods, we enable our clients to establish preventive measures and standards. Insights from the past, predictive solutions, and the utilization of external data sources help our clients proactively prevent cases of damage.

Do you have any questions or would you like to find out more about our services?

Contact us for a non-binding consultation.

Project references

Healthcare - Investigation Project

Supporting the project in collaboration with authorities, including recording, reviewing, and documenting business transactions through data collection and analysis.

Banking Sector - Special Audit

Project and investigation support for a BaFin special audit for the compliance function according to §35 WpHG, including coordination with the external auditor, project management, and audit-proof documentation.

Banking Sector - Investigation Project

Banking Sector - Fraud Investigation/Processes

Defining investigation processes and corresponding business requirements for the implementation of a Case Management System, including implementing a concept and process for cross-departmental reporting on fraud risks.

Your Experts

Jobs @ 4C

Feel free to reach out to us!

We would like to point out that this website only provides a limited insight into our services. Our expertise and range of services cannot be fully represented on this platform. For personalized advice and to address your specific concerns most effectively, we warmly invite you to contact us directly so that we can offer you a tailor-made solution.

Thank you for your trust. We look forward to hearing from you.